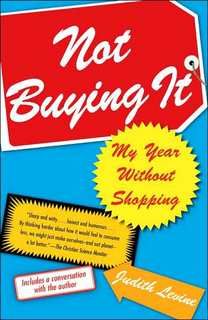

As the title no doubt gives away, the author decides to give up shopping for a year. She buys only ‘necessities’, but foregoes things like movies, eating out, and new clothes (mostly).

It’s interesting to me as much for what it’s not as what it is.

Most people who turn to this kind of extreme consumer deprivation do so because they are going through traumatic financial times. For example, they may have gotten themselves so deep in debt that the minimum payments alone could bankrupt certain small nations. (Raises hand.)

From the review on Barnes and Noble: Not Buying It is no primer on the simple life and how to live it. It's the confessions of a woman any reader can identify with: someone who can't live without French roast coffee or SmartWool socks but who has had it up to here with overconsumption and its effects on the earth and everyone who dwells there

Long ago, I went through a similar cycle of not buying it - because I had to, because I literally did not have the money. Because I had to focus on those debts and get rid of them – they were sucking our life out of us, one interest payment at a time.

Back then, the list of debts was ‘too long to list here’.

Today, I have five: Mortgage, minivan payment, car payment, loan-for-furnace, loan-for-surgery-last-year.

That’s it. And none of those loans is at over 5% interest. A far, far cry from the days when my lowest interest rate was 18%.

Everything else is paid off as it comes in. Car and home insurance bills are paid annually at renewal. The credit card I use for daily purchases is likewise paid off each month.

We are in the blessed, blessed position of having enough plus a little extra. I can go to the supermarket without checking my account balances first, but if I’m heading to Best Buy a quick reality check is definitely in order. And, we’re funding our retirement quite nicely.

The new discretionary budget (money I can spend on any fool thing I want) is a lot tighter than I’d like, though, so I find myself thinking about ways I can pay off some of those five things sooner, to put the monthly payments back into said discretionary budget.

As I’ve been pondering the ways and means, and reading Levine’s book, I find myself thinking…what could I accomplish with the resources and (more importantly) the knowledge I have now?

I know how to work the banking system. I know that I will not, in fact, curl up and die if I don’t have…a vacation, or a new pair of shoes, or gourmet coffee. (There. I said it. I will not die if I have to drink Costco coffee.) I know how to leverage what I’ve got to maximize benefit.

One year. If I spent one crummy year trying to do my personal best with what we’ve got – what could I do? Where would we be, what could we have?

Right now, my discretionary budget is $600 a month. That’s for groceries, gasoline, vacations, ballet lessons – anything that doesn’t involve a monthly bill. Not a whole lot, for a family of six. It feels like a slightly-too-tight turtleneck, frankly, and I’ve been having trouble settling into it. I’ve gotten into a habit of overbuying (and under-thinking, if I’m brutally honest with myself).

If I took one year, just 1.25% of my guesstimated lifespan, and spent it working at both economizing and tightening the overall ship…what kinds of things would become possible for us?

Just what could I do, in a single measly year?

I have a feeling it could be rather impressive.

And even…fun.

In a bizarre, household-economics-nerd kind of way…

3 comments:

And the thought scares me senseless, because consumerism is one of my ways of dealing with stres...the fact that I may be able to quit my job if I figured out how to spend my money makes me want to weep.

Thank you for reminding, yet again, that I really DO need to look at my budget instead of just crossing my fingers and hoping it all works out. Not a good strategy.

$600 would not cover my monthly groceries and gas, not to mention the other expenses you listed! Just having two cars driven to/from work each day sucks up half of that $600. Then, I spend about $600 per month on groceries.

So, I don't understand how you're doing it, but BRAVA!!

Post a Comment